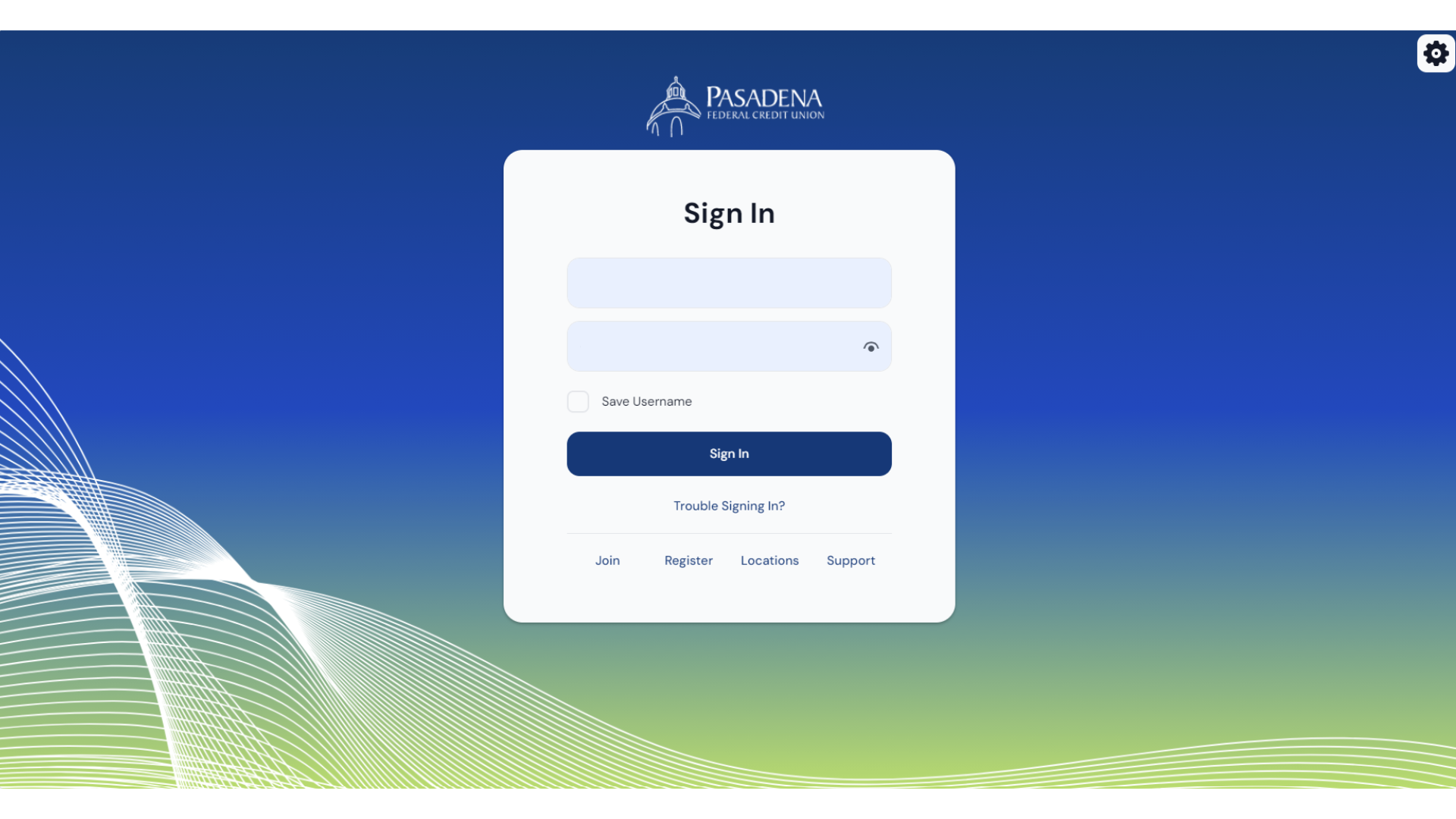

Your own personal branch at your fingertips!

- Brand new interface with a refreshed look and feel.

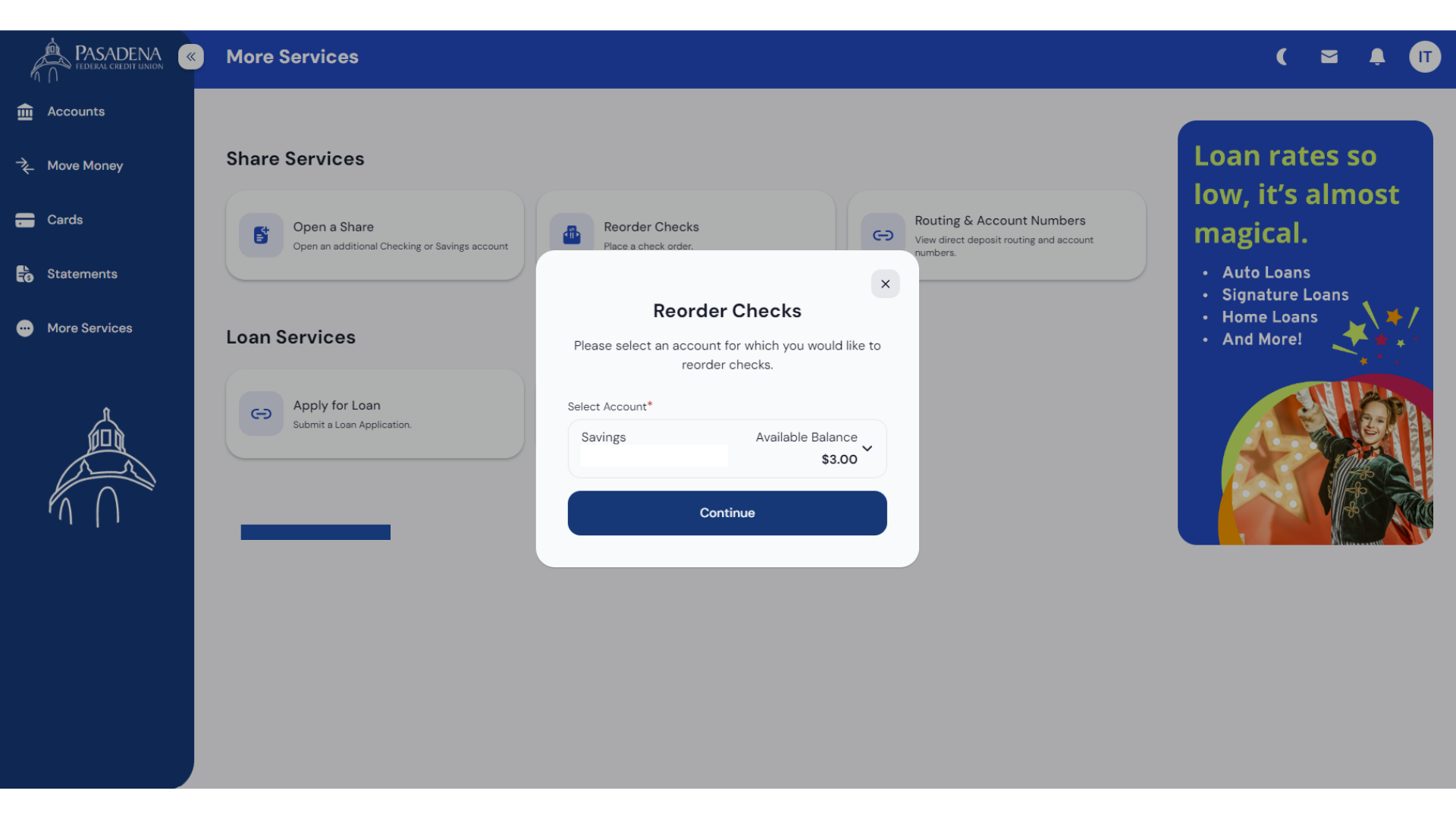

- Easily update your email, phone number, or address on your account(s).

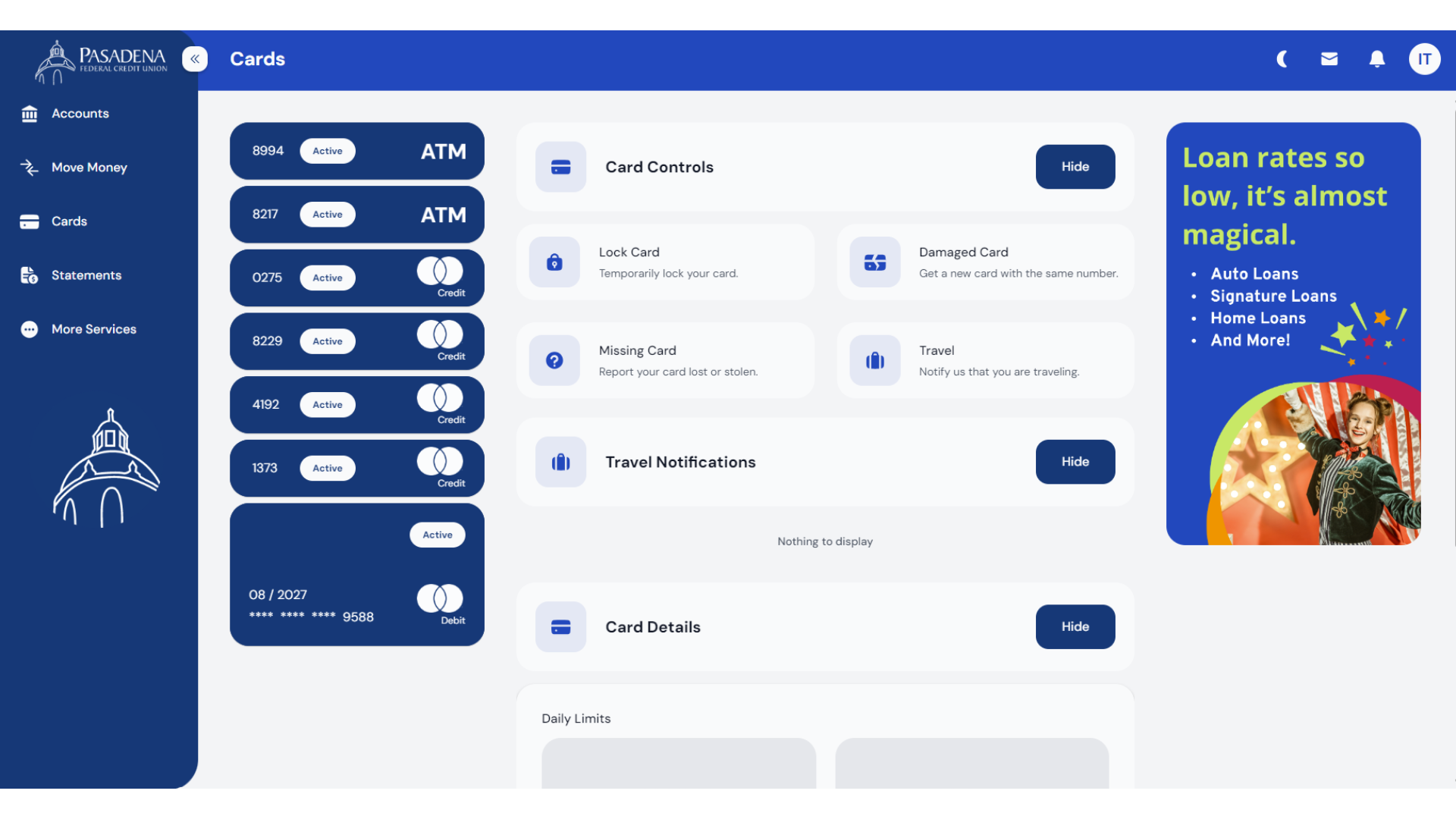

- Card Controls for Debit and Credit to report lost/stolen.

- Improved search options for Account Balances.

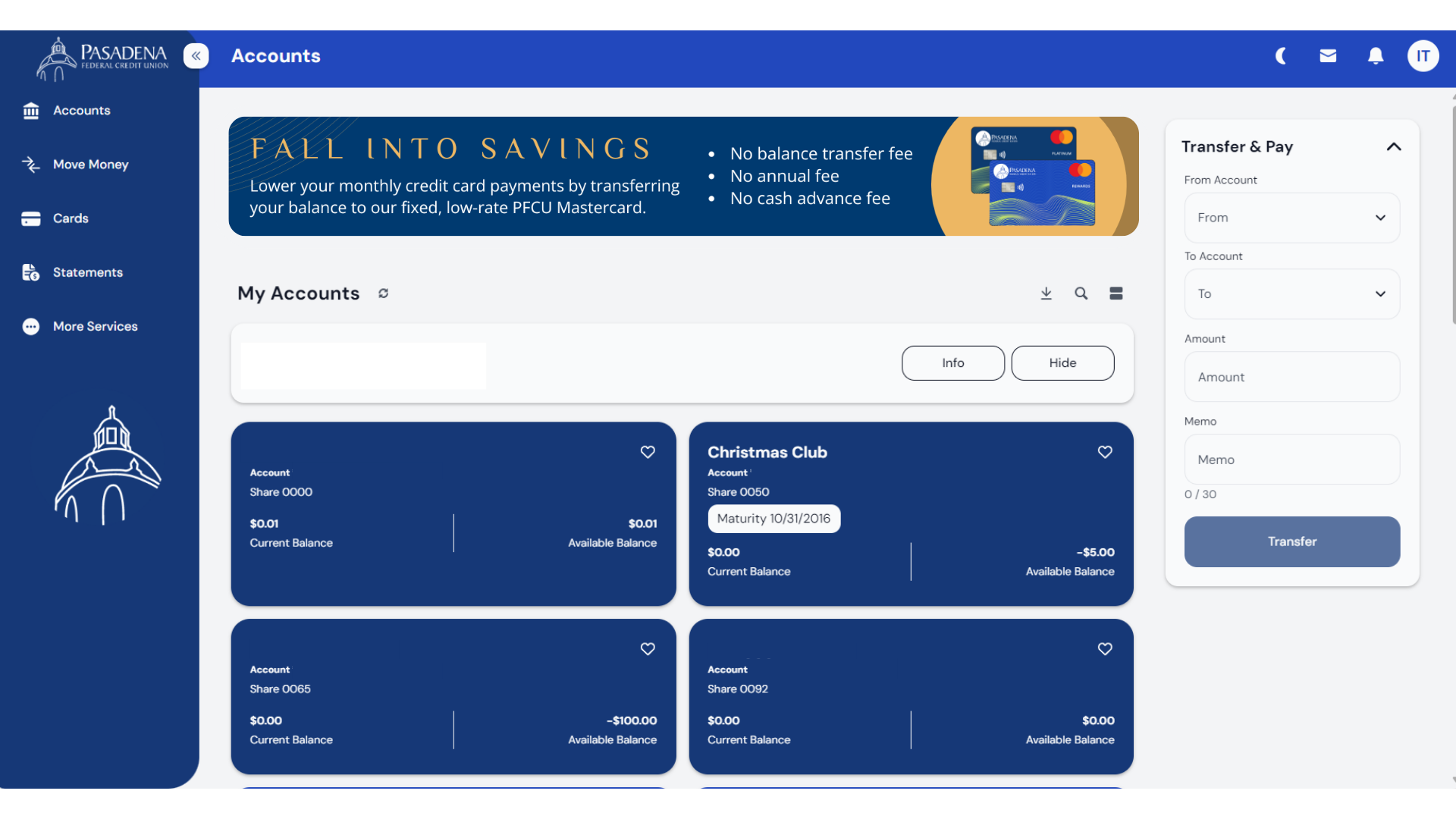

- A combined Transfer and Payment section.

- Improved security and privacy settings such as a toggle button to show/hide account and routing numbers.

- Visual impairment assistance.

- Spanish as a default second language.

- And more!

- View your current balance and account history

- Schedule transfers in advance

- Transfer funds between deposit accounts

- Set up alerts to be notified when activity occurs

- View and print cleared checks online

- Make loan payments through the Payments section

- Customize the layout of your dashboard

- Pay your bills with online Bill Pay

- Brand new interface with a refreshed look and feel.

- Easily update your email, phone number, or address on your account(s).

- Card Controls for Debit and Credit to report lost/stolen.

- Improved search options for Account Balances.

- A combined Transfer and Payment section.

- Improved security and privacy settings such as a toggle button to show/hide account and routing numbers.

- Visual impairment assistance.

- Spanish as a default second language.

- And more!

- Schedule recurring or one-time payments

- View all payees, upcoming bills, and payment history

- Add, delete or modify payees quickly

- Pay any person with one click

- Set up recurring payments for bills that are the same each month

- See bill amounts and payment due dates with eBills

- "Go green" and reduce household clutter at the same time

- Put important financial information at your fingertips

- Make it easier to identify suspicious transactions

- Save money in the long run by identifying spending patterns

- Reduce the risk of ID theft by keeping your financial data out of the mail

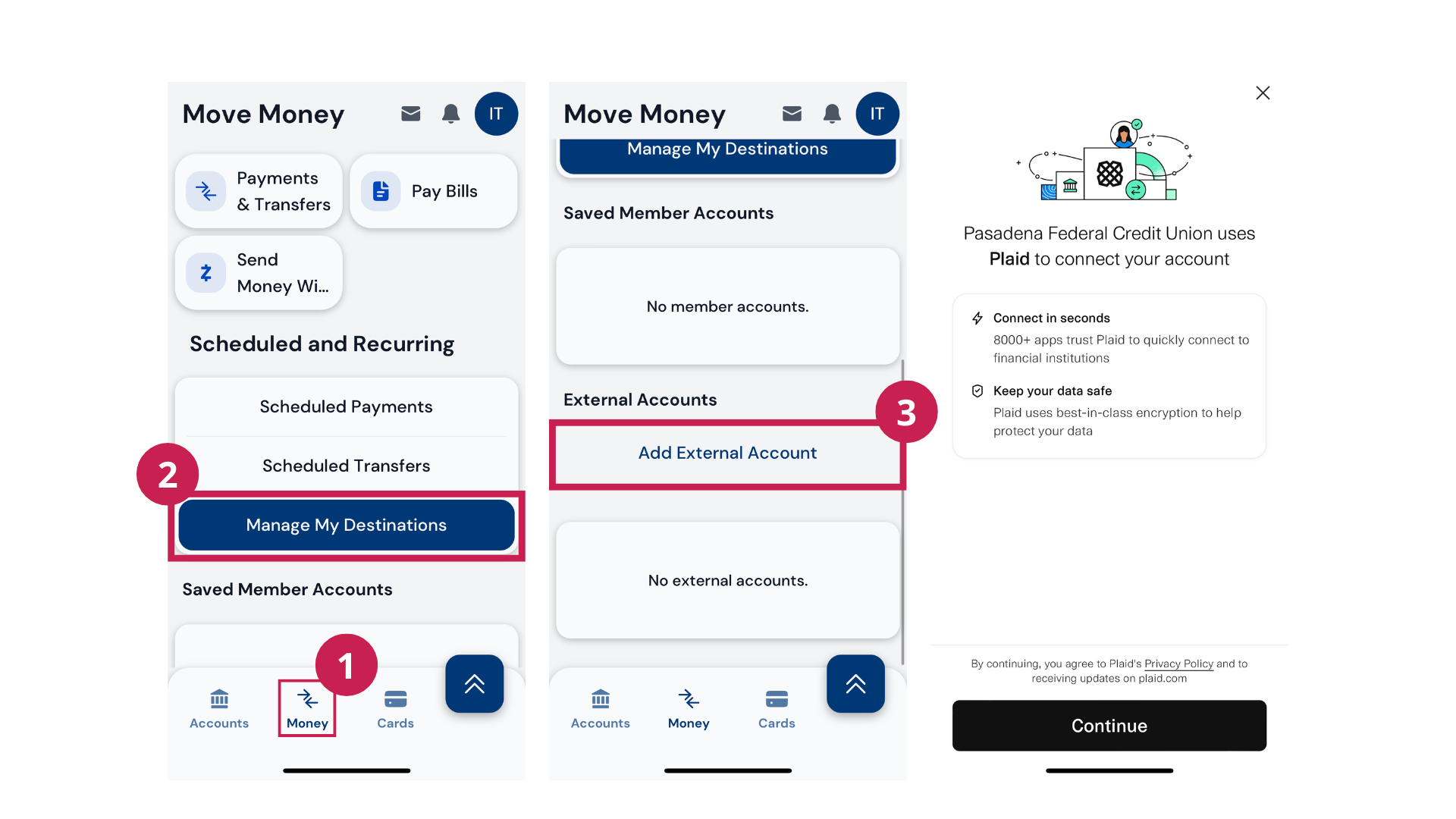

We’ve partnered with Plaid to bring you a better banking experience by making it possible to instantly link your external accounts!

With Plaid, you can now transfer money easily between your accounts and link an external bank/credit union account to PFCU. You will now be able to easily transfer funds from another financial institution to PFCU to pay your loan(s).

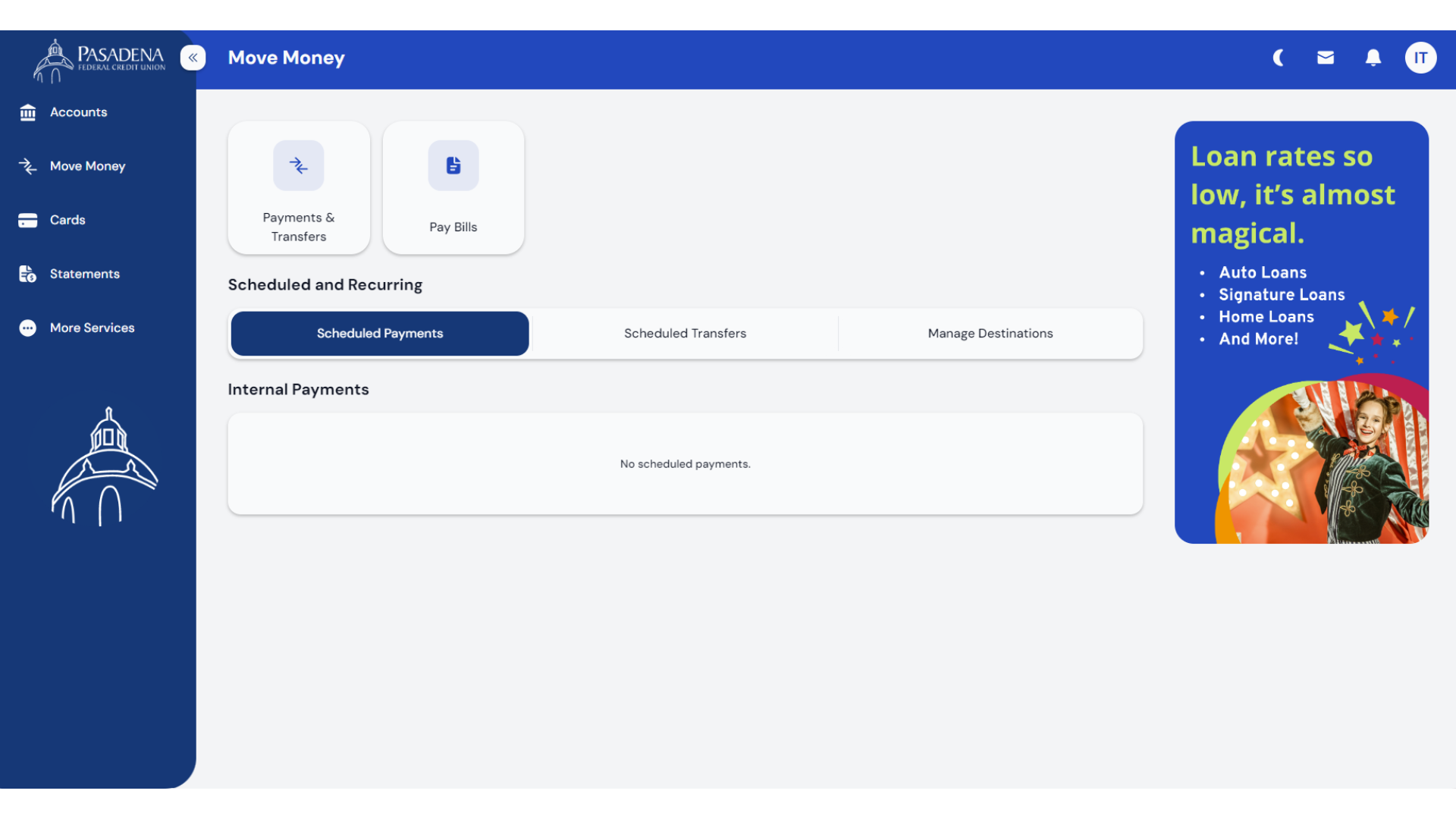

To use this feature, simply go into “Move Money” from within PFCU Online Banking and Mobile App. You will be asked to provide your online banking credentials associated with the external account to complete the process once you're within the Plaid environment. Depending on your external account's financial institution, some of them may require micro deposits for an additional layer of account verification before they connect the two accounts.

Below are some screenshots on where to find Move Money>Add External Account.

Mobile App:

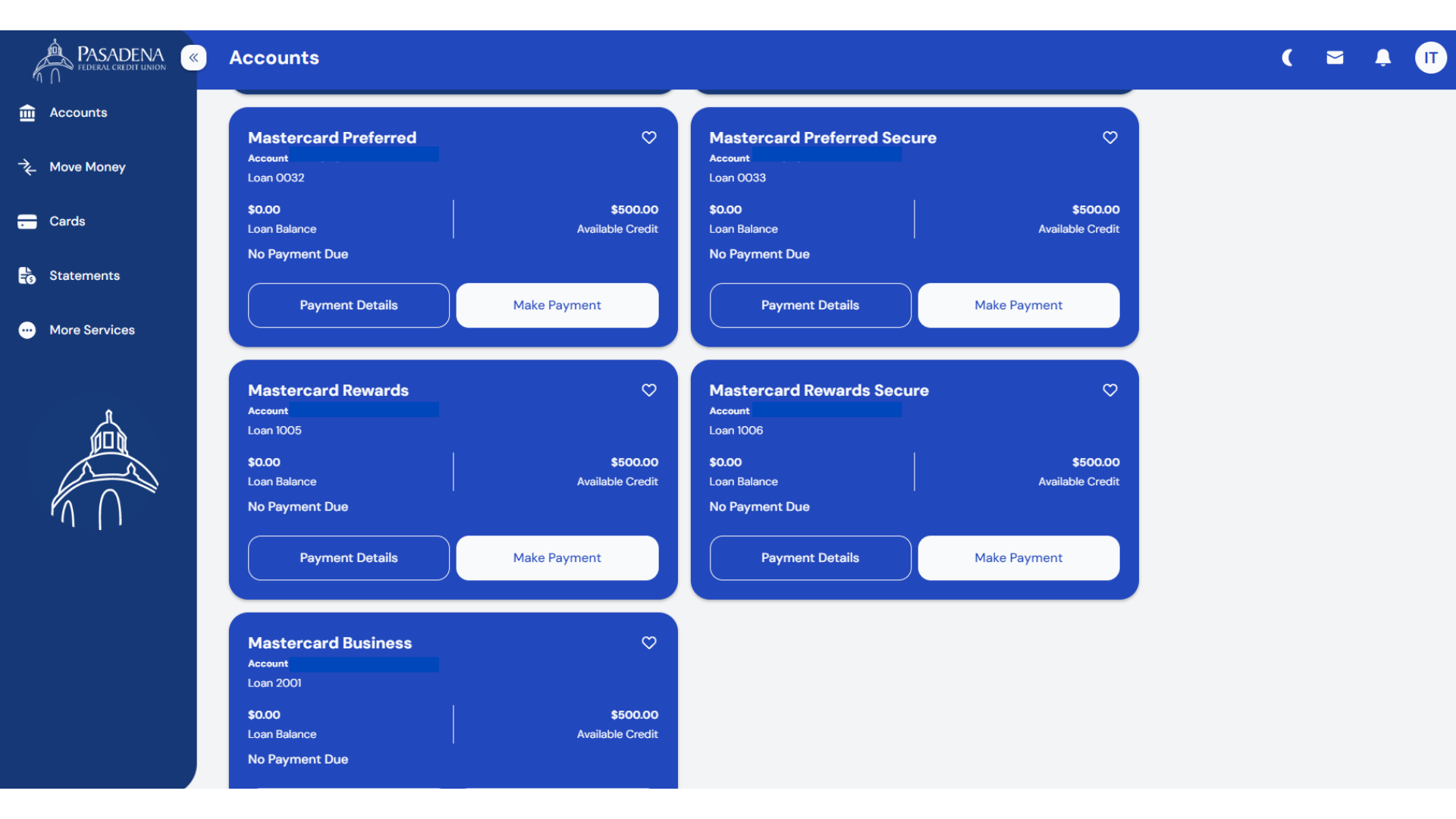

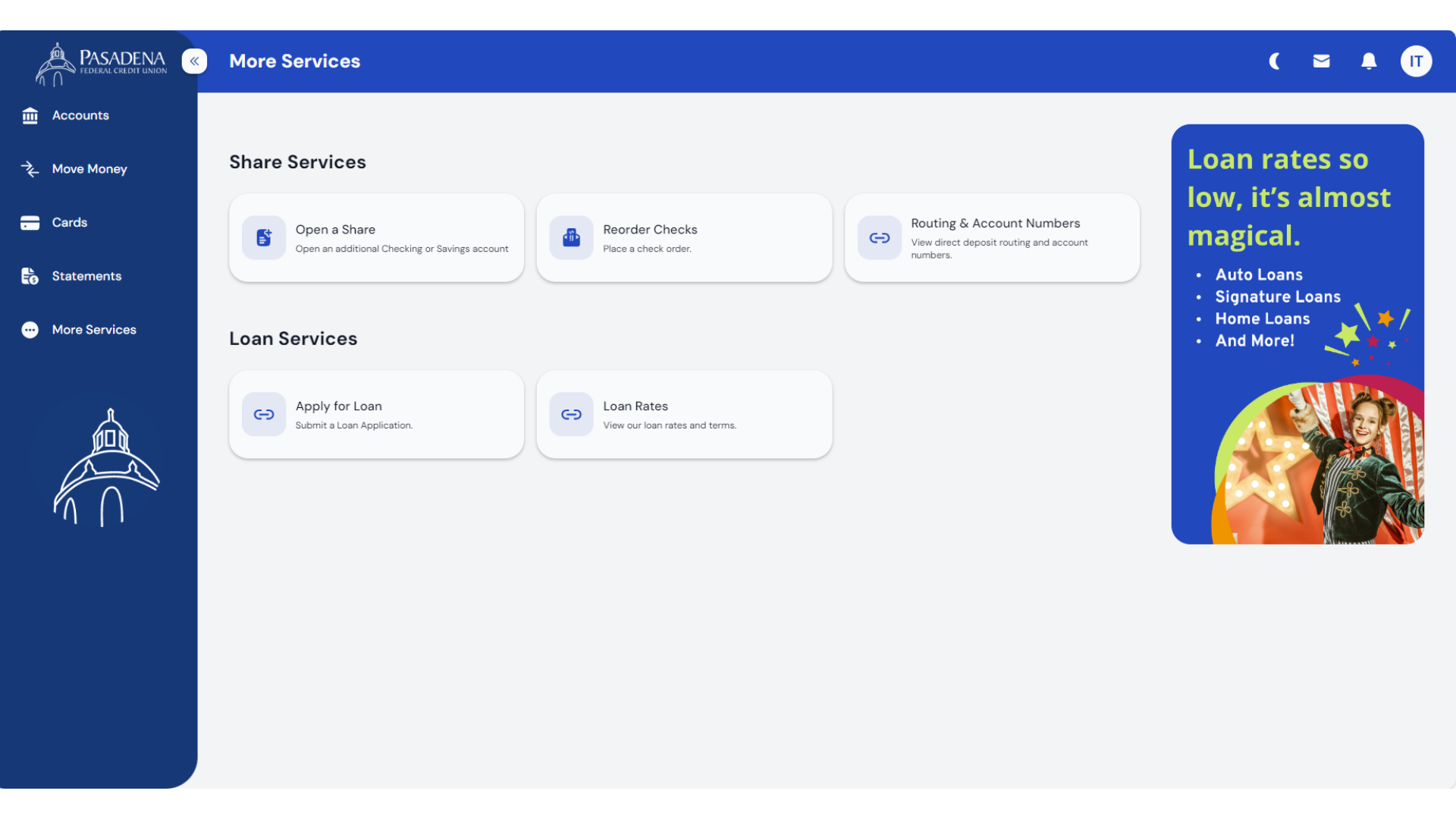

Online Banking:

Frequently Asked Questions

What if I don’t see my other financial institution within Plaid?

If your external financial institution doesn’t appear in the list, the financial institution doesn’t have a relationship with Plaid. Instead, you will need to link your accounts manually utilizing micro-deposit verification. Once you initiate the verification process, which can take 2-3 business days, you’ll receive one small deposits in your external account. Enter the amount that was deposited to your account at your other financial institution and follow the screen prompts. Once you add your external account and complete verification of the account, you will not need to do it again, unless you remove the external account and want to add it back.

What if my credentials are not accepted?

If your credentials from your external financial institution are not accepted, please verify that the information you are using is correct. If you are still unable to connect your external account, you can still add an external account by completing the micro-deposit verification process.

How do I know that Plaid is safely using my information?

Plaid is certified in internationally recognized standards. They utilize encryption safeguards, multi-factor authentication, independent security testing, and much more to ensure your information is safe. Additionally, Plaid doesn't sell or rent your data to outside companies. For more information on Plaid's safeguards, please visit https://plaid.com/safety/.

What if my external account is already linked?

If your account is already linked, you won't need to relink that account. Plaid will only be initiated when you have new external accounts to link to your Pasadena FCU account.

The financial institution added to my external account list is different than the one I selected in Plaid.

Some financial brands use a partner bank to provide their banking services. For example, Chime® uses Bancorp, Inc. and Stride bank to offer their banking services.

I don’t recognize the security questions asked by Plaid. Where did they come from?

Any security questions asked by Plaid come directly from the external financial institution you're attempting to connect to. Please contact your external financial institution if you're having difficulty with your security questions.

Plaid says the financial institution I’m attempting to connect is having connectivity issues. What should I do?

You may be able to connect your account to Plaid later. However, if Plaid notes "Connectivity not supported" for the selected financial institution, you will need to exit Plaid and use manual verification instead.

Plaid is taking me to my other financial institution’s login page. What is happening?

Several financial institutions have users authenticate directly with them instead of through Plaid. Typically, these institutions will also have you select which accounts you want to share with Plaid before you can complete your connection. You can expect this when connecting accounts from Bank of America, Capital One, Chase, and Wells Fargo.

Rates lower than most in the area.

Renovating, landscaping or just in need of a line of credit for unexpected expenses, we can help. Enjoy rates as low as 7.25% APR*.

.png)